SEOUL, Korea (Oct. 22, 2020) – LG Display today reported unaudited earnings results based on consolidated K-IFRS (International Financial Reporting Standards) for the three-month period ending September 30, 2020.

◆ Revenues in the third quarter of 2020 increased by 27% to KRW 6,738 billion from KRW 5,307 billion in the second quarter of 2020 and increased by 16% from KRW 5,822 billion in the third quarter of 2019.

◆ Operating profit in the third quarter of 2020 recorded KRW 164 billion. This compares with the operating loss of KRW 517 billion in the second quarter of 2020 and the operating loss of KRW 436 billion in the third quarter of 2019.

◆ EBITDA in the third quarter of 2020 was KRW 1,288 billion, compared with EBITDA of KRW 413 billion in the second quarter of 2020 and with EBITDA of KRW 613 billion in the third quarter of 2019.

◆ Net income in the third quarter of 2020 was KRW 11 billion, compared with the net loss of KRW 504 billion in the second quarter of 2020 and the net loss of KRW 442 billion in the third quarter of 2019.

LG Display registered KRW 6,738 billion in revenues and KRW 164 billion in operating profit in the third quarter of 2020.

The revenue increase of 27% quarter-on-quarter was driven by a continuous rise in panel shipments for IT products thanks to the growing trends of working from home and online schooling, as well as an increased supply of panels for new mobile products from strategic customers, strong global TV sales, and the start of full-scale mass-production at the company’s OLED panel production plant in Guangzhou, China.

LG Display returned to the black for the first time in seven quarters, with an operating profit of KRW 164 billion, due to an improved overall performance across its business sectors. It recorded KRW 11 billion in net income and KRW 1,288 billion in EBITDA along with an EBITDA margin of 19% in the quarter.

The company saw a continued increase in panel shipments in the IT sector in the third quarter due to its differentiated competitiveness and proactive response to a changed environment caused by COVID-19. There was meaningful improvement in profitability in the P-OLED sector for mobile devices due to an increased supply of panels for new mobile products from strategic customers. Regarding the TV sector, the start of full-scale mass-production at the company’s Guangzhou OLED panel plant, along with its flexible management of LCD production lines in response to the favorable supply and demand situation of large-size LCD panels, contributed to a significant reduction in deficit.

Panels for IT devices accounted for 43% of the revenue in the third quarter of 2020, having made up the largest revenue share since the previous quarter. Panels for TVs accounted for 28%, 5% up quarter-on-quarter, while those for mobiles and other devices accounted for 29%, 4% up quarter-on-quarter.

LG Display recorded 192% in the liability-to-equity ratio, 97% in the current ratio, and 90% in the net debt-to-equity ratio as of September 30, 2020. The company’s debt decreased by KRW 310 billion in the quarter, halting the rise in debt that had continued since 2017 when large-scale capital expenditures took place. The company will take proactive financial management steps, while keeping the worst-case scenario in mind, in response to a business environment with high uncertainty and volatility.

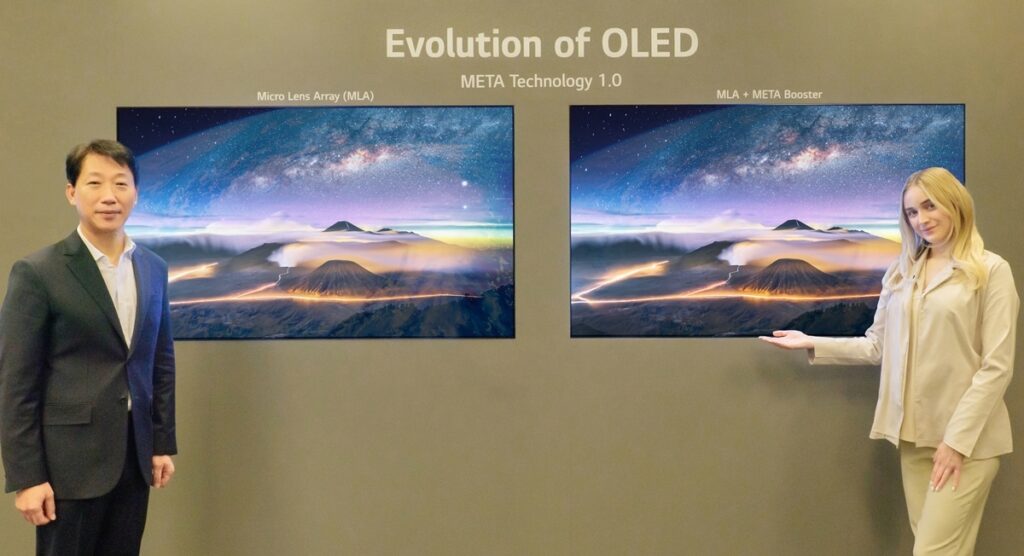

In addition, the company will continue to strengthen its leadership in the market with its large-size OLED technology which can meet the consumer’s various needs by representing unmatched picture quality, design flexibility, as well as being exceptionally easy on the eye. With the start of the Guangzhou OLED panel plant operation on a full scale, the company has already secured stable supply and therefore expects to see shipments double in the second half of this year compared with the first half, with annual production set to reach 7-8 million units next year.

As for the LCD sector, LG Display has been “accelerating structural innovation of the LCD business” while maximizing opportunities for IT products by switching some Korea-based LCD production lines from TVs to IT products to prepare in advance for an active response to opportunities in the market. In addition, the company will respond flexibly to customer needs and the short-term supply and demand situation for Korea-based LCD production lines for TVs within the range of existing facilities and available manpower. The company will also focus more on operating a stable business for P-OLED based on its strengthening relationship with strategic customers and on its stable production and quality of products, minimizing variability in the off-season.

“As lifestyles have changed due to COVID-19, TV products have been used not only for viewing purposes, but also for games, working-from-home, and home training,” said Dong-hee Suh, CFO and Senior Vice President of LG Display. He added, “Considering that OLED is the only display technology that is optimized to meet the consumer’s needs for new experiences, as well as to flexibly provide new form factors, we will continue to focus on expanding OLED’s market leadership.”