SEOUL, Korea (Apr. 26, 2023) – LG Display today reported unaudited earnings results based on consolidated K-IFRS (International Financial Reporting Standards) for the three-month period ending March 31, 2023.

◆ Revenues in the first quarter of 2023 decreased by 40% to KRW 4,411 billion from KRW 7,302 billion in the fourth quarter of 2022 and decreased by 32% from KRW 6,471 billion in the first quarter of 2022.

◆ Operating loss in the first quarter of 2023 recorded KRW 1,098 billion. This compares with the operating loss of KRW 876 billion in the fourth quarter of 2022 and with the operating profit of KRW 38 billion in the first quarter of 2022.

◆ EBITDA loss in the first quarter of 2023 was KRW 80 billion, compared with EBITDA profit of KRW 209 billion in the fourth quarter of 2022 and with EBITDA profit of KRW 1,211 billion in the first quarter of 2022.

◆ Net loss in the first quarter of 2023 was KRW 1,153 billion, compared with the net loss of KRW 2,094 billion in the fourth quarter of 2022 and with the net income of KRW 54 billion in the first quarter of 2022.

LG Display registered KRW 4.411 trillion in revenues and KRW 1.098 trillion in operating loss in the first quarter of 2023.

LG Display saw a decrease in panel shipments and revenues in the first quarter due to low seasonality and shrinking industry demand mainly for TV and IT products, as set makers continued to aggressively adjust their inventory levels. In addition, the company’s continuous efforts to enhance the overall business structure by downsizing its LCD TV panel business also affected the revenues.

Panels for TVs accounted for 19% of revenues in the first quarter, while panels for IT devices including monitors, laptops, and tablet PCs accounted for 38%, panels for mobile and other devices accounted for 32%, and those for automobiles accounted for 11%.

LG Display will make an all-out effort to advance its business structure centered on market-to-order business, which manages to maintain stable shipment and price operations based on close partnerships with its customers, while continuously focusing on improving its differentiated competitiveness to prepare for the future.

With respect to the market-to-order business which now accounts for over 40% of the revenue, LG Display plans to further expand the revenue share by over 70% within the next two to three years. Additionally, the company will further solidify its global leadership in the automotive display sector by increasing orders and revenues while expanding the shipment of high value-added panels for mobile devices scheduled for additional mass production this year. For its mid-sized OLED business including tablet PCs which it is currently investing in, the company aims to prepare for a solid mass production and supply system in 2024 based on its technological leadership.

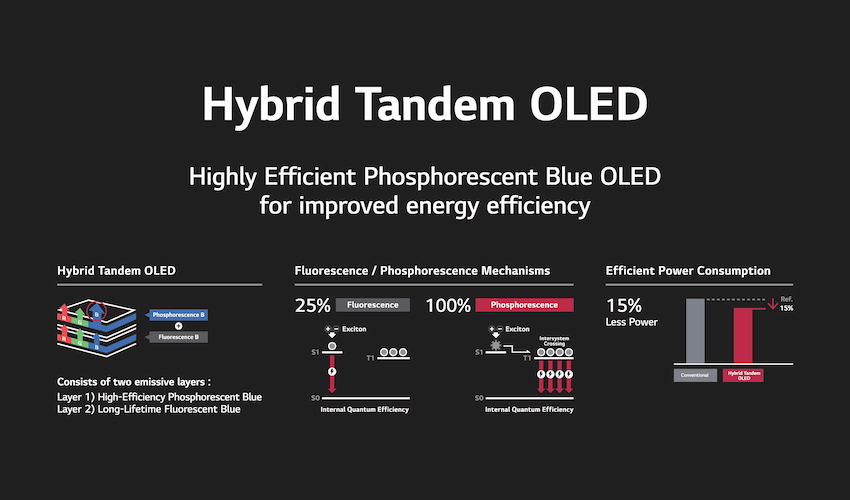

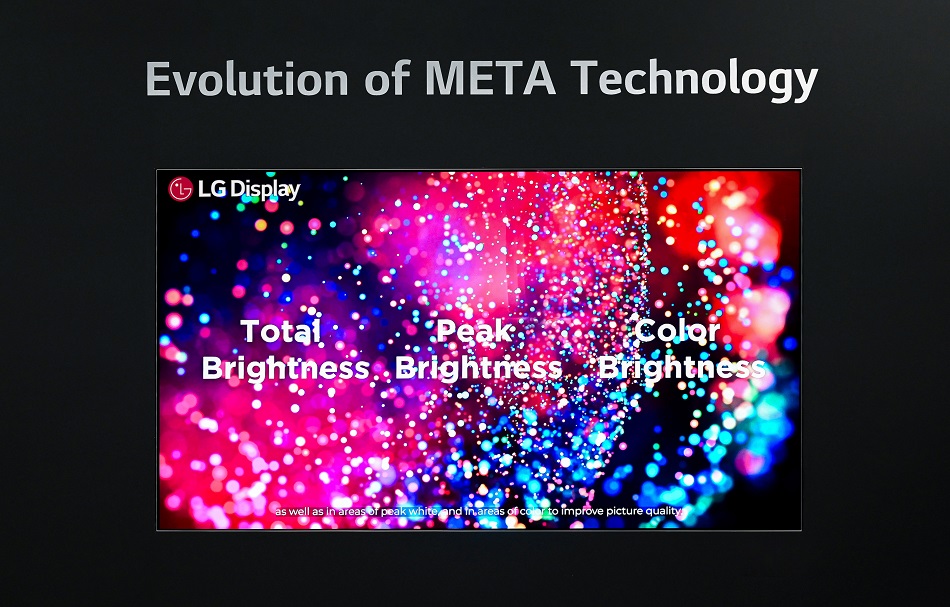

In addition, LG Display will focus more on high value-added areas for its supply and demand-based business which is vulnerable to market volatility. The company will continue to strengthen its position in the premium TV market with its large-sized OLED by expanding its product lineup underpinned by stronger fundamental competitive edge characterized by brightness and energy efficiency and by innovating cost structure. The company will also accelerate its market-creating business with high growth potential such as Transparent and Gaming OLED panels.

“Panel demand is predicted to fall short of actual set sales as set makers anticipate a prolonged period of sluggish demand. However, we now bottom out in the first half and plan to achieve a turnaround during the second half of the year, as the industry recovers its inventory level and soundness. This will in turn lead to increased demand in panels and the expansion of market-to-order business including an increase in shipments of panels for mobile devices,” said Sung-hyun Kim, CFO and Senior Vice President at LG Display.

Kim added, “Despite continued macroeconomic uncertainties, we will make every effort to improve our business performance by accelerating the advancement of our business structure and maintaining intense activities to reduce our costs.”